Do expats pay taxes abroad?

Nobody likes it, but almost everyone engages in it on a daily basis … paying taxes.

When you’re setting up Flags all over the world, or just moving to another country, one of the inevitable questions that pop up is: Do I still have to pay taxes abroad?

The short and most likely answer is: probably. The long answer is: it depends a lot on where you come from and where you go. We’ll discuss the different scenarios in this article.

Check out my new book, available on Amazon!

Get the bookDo expats pay taxes?

In many cases yes, in some cases no, in most other cases it depends on the country you are a citizen of, a resident of, and where you get your income from.

If you make money in the country you reside in, you will almost always have to pay taxes on that income.

Yes, I agree that it’s deplorable that governments forcibly take a percentage of what you earn, but that’s the way the world works.

There are only a few countries where there aren’t any income taxes whatsoever, like Dubai.

These are obviously great and can be highly recommended to move to just for this reason alone, because imagine if your income isn’t being taxed 50% or more … you’re saving so much money, it often offsets the higher cost of living in countries like Dubai.

But for the purpose of this article, we’ll assume you aren’t earning money from the country where you reside in, because, as I’ve talked about many times, this isn’t a good idea for so many reasons, such as getting taxed and being tied to that one country

Let’s say you have location independent, international income: you earn money from all over the world, not from the country where you reside in.

Do you still have to pay taxes on that income?

After all, why does the government of, say, France, have any affairs with money you earn from, say, Peru?

Of course, what’s fair and logical isn’t what is being used to determine this.

There are 3 possible scenarios:

Income tax on foreign income: Worst case scenario

The worst case scenario when moving abroad regarding taxes is always having to pay taxes on your income, regardless of where you live or where that income comes from.

Fortunately, there are only a very few countries in the world with such a deplorable and greedy system, of which, of course, the United States of America, the land of the free, is one.

If you are an American citizen, you will always have to pay taxes on your income, regardless of where this income derives from, and regardless of whether you still live in the US or not.

Yes, you heard this right, even if you don’t have legal residence in the US anymore, but in a country which has nothing to do with it, you’ll still have to pay taxes on your income.

You can, however, apply for a tax-exempt portion of your income, slightly over $100,000 a year.

This is by far the worst case scenario, and for this reason it’s a good idea for high-income Americans to renounce their citizenship once they have it in 2-3 other countries.

Another slightly better, but still horrible, scenario is always having to pay taxes on your international income to the country where you are residing in.

Income tax on foreign income: Best case scenario

The best case scenario of paying taxes abroad is, obviously, not having to pay taxes at all.

Dubai was already mentioned as shining example of how it should be, and in this United Arab Emirate you don’t have to pay income taxes whatsoever.

Unfortunately, there aren’t many countries at all with such a lenient system.

Fortunately, apart from the fully income-tax-exempt countries, there are also many options which do tax income you earn inside their borders, but not your international income.

Since you, as a Citizen of the World, of course have such income, this basically comes down to the same thing, because you won’t be paying taxes on your income.

Examples of great nations with this system are more plentiful:

- Singapore

- Malaysia (until the end of 2026 so far)

- Hong Kong

- Paraguay

- Bolivia

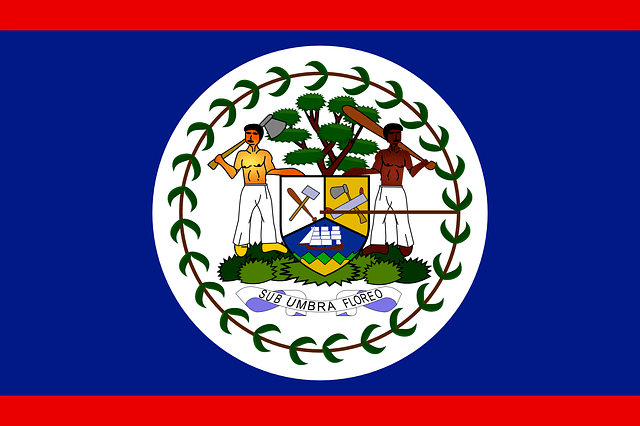

- Belize

- Uruguay

- Panama

- Costa Rica

- Ecuador

- Zimbabwe (interest, dividends etc coming from outside the country are taxable)

- Dominican Republic

- Dubai

- The Bahamas

- Qatar

- Tahiti (probably, I’m not 100% sure)

As you can tell, there are quite a few options here, spread across the world.

No matter where you decide to live, you can make it work without paying taxes – as long as you have international income.

Furthermore, there are also countries where you don’t pay a capital gains tax, which makes them ideal for setting up Assets in:

- Bahrain

- Belize

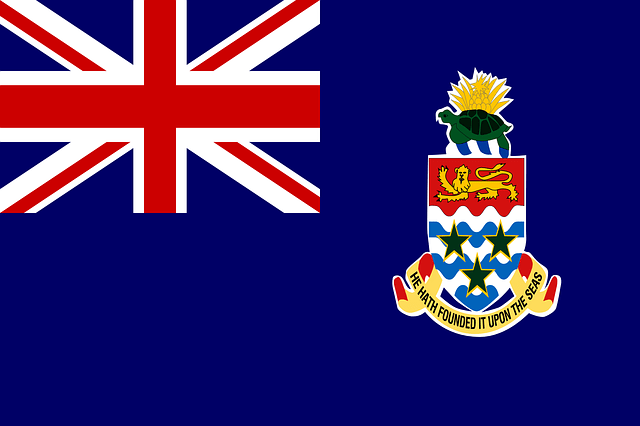

- Cayman Islands

- Singapore

- Hong Kong

- Malaysia

If you have a business, you can do really well by placing it in a country which doesn’t have a high corporate tax.

There are around 10 countries which charge 0%, but not all are recommended:

Singapore

The corporate tax rate is 17%. Pretty easy and fast to set up a business and it doesn't cost a lot. Even though there is a pretty high corporate tax, I still include Singapore because it's one of the very few decent options in Asia.

Vanuatu

The corporate tax rate is 0%. A great option, but setting up a business here is more complicated than the other countries in this list. You have to register for all sorts of things and go through quite a bit of paperwork.

The Bahamas

The corporate tax rate is 0%. They also do not tax profits, personal income, dividends, capital gains, inheritance, gifts and unemployment taxes. In the Bahamas you have an additional layer of privacy and many incentives for international investors. All in all, a great option.

Bermuda

The corporate tax rate is 0%. There are no income or capital gains taxes on corporate entities in Bermuda, nor any withholding, inheritance or capital transfer taxes. This is a major international business center. Setting up a company is pretty easy and fast, but it will cost some money, around $18,000.

Cayman Islands

The corporate tax rate is 0%. These islands are considered a tax haven. If you want to open a business which operates inside the islands, you must first get permission to open a business, and 60% of your company must be of Cayman ownership or provide goods/services that are deemed essential to the country. If your business will be conducted outside of the country, the requirements are much, much laxer, with low fees.

Belize

The corporate tax rate used to be 0%, now it lies between 1.75% and 3%. It is still considered a tax haven because it's easy to set up a(n offshore) business. Belize does not share information with international taxing authorities, which means you have complete privacy. Do keep in mind that the Belizean dollar is tied to USD, which will be a really bad situation once that nation goes under.

So if the worst case scenario comes down to always having to pay taxes on all your income (as in the case of US citizens), and the best case scenario is never having to pay any taxes on your income (as is the case in Dubai), what can you expect if you move to any other country apart from the aforementioned list?

Income tax on foreign income: The most common scenario

Okay, so unless you move to any of the aforementioned international-income-is-tax-exempt countries, what can you expect when you move abroad?

Well, you’ll usually have to technically pay taxes on your international income, ranging from 1% to 50% (or so), when you hit certain criteria, even if you’re not a legal resident.

Many countries consider you a “tax resident” when you spend more than 183 days per year in their territory.

Other criteria could include having an abode there, or having spent a certain amount of time there the past few years.

In short, if you plan on settling abroad in any country other than the ones I mentioned in the previous section, you’re technically forced to pay taxes … but that raises the next question:

Should you pay taxes abroad?

Before I answer this question, let’s make two things clear:

- I am radically opposed to income tax, and I think it’s horrific that governments take money you earned, and that people put up with this shit

- That said, do nothing illegal, because if you do, governments have the power to make your life a living hell. Just be smart about it

With that in mind, I would say that you shouldn’t have to pay taxes, but you probably will have to … unless you can avoid it, by (in order of preference):

- Moving to a fully-tax-exempt nation

- Having international income and moving to country which doesn’t tax that

- Having international income and moving to country which does tax that, but not hitting any of the criteria which make you a tax resident. So for example you can spend 5 months a year in a certain country, then travel to another one where you have a Flag, then to a 3rd, and keep that rotation going. As you’re never longer than 183 days in a single country, you don’t have to pay taxes in most cases

- Having international income and moving to country which does tax that, and stay there for years on end, but make it very unlikely that the government there will ever tax you. For example you can just not open a bank account there, and only withdraw money using ATMs and a foreign bank account. This could land you in trouble I guess, but it seems unlikely

I’ll repeat, this isn’t legal or financial advice whatsoever, consult an accountant or lawyer before taking any steps.

So there you have it: paying taxes abroad in a nutshell.

Is it ideal? Sometimes definitely not, but in many cases it is FAR, FAR better than the system you are currently laboring under in your nation of birth.

Fuck paying 50%+ of your hard-earned (relatively speaking) money to some inept and inefficient government.

Move abroad, get international income, and actually keep what you earn.

Check out my new book, available on Amazon!

Get the book