Where to set up a business?

If you want to be free to escape the West, you need to be self-employed with an international income.

That means you are your own boss and you can earn money from wherever you are in the world – ideally from non-Western countries (although this is not yet a requirement, it will certainly be so in the coming years).

Want to spend a month bumming it out in Thailand? You are free to do so, and you can keep working and earning money while doing so.

Rather live it up in Dubai for a while, and then see where life takes you? Not a problem, you are your own boss and your income is not tied to your location, so you have that option.

Sounds rather awesome, right? And the best part – anyone can do this.

Setting up sources of international income is not difficult, at all.

You can be a freelancer, day-trader, consultant, have a YouTube channel, a blog, do affiliate marketing, the options are nearly endless.

I’m not an idiot, but I am by no means a genius with plenty of talent.

So if I, in all my mediocrity, can set up such a life, so can you.

Today we’ll talk about your Business Flag. Earlier I’ve discussed other Flags, and where you can set them up:

Check out my new book, available on Amazon!

Get the bookHow to set up an international business?

How you can set up a business and which requirements you’ll need to fulfill depend heavily on the country where you want it to be based.

I cannot give you many general guidelines, just the rather dull advice to do thorough research beforehand, make sure you have the required funds, and prepare all the necessary documents before actually going there.

Most of the countries I will recommend in this article make it pretty easy to set up your business by yourself, but if you can spare the money, I’d recommend you hire a local corporate lawyer to help you navigate the bureaucratic mumbo-jumbo.

Where to set up a business?

Once you want to start with your own business, the inevitable question arises: where to set up a business?

You do not want your business(es) to be located in most Western nations, such as the US, France, and Canada.

For starters, businesses are often heavily taxed there, more so than many other countries in the world (however, still less than individual employees – so wherever you create your business, it’ll still be better tax-wise than being an employee).

The average global corporate tax rate is around 24%.

Many Eastern European countries do have low corporate taxes, so those are an option … but of course those come with other risks, such as corruption, sometimes unstable governments, and so on.

Technically, the United Arab Emirates has the highest corporate tax in the world, but this will almost certainly not affect you, as it is is primarily paid by gas and oil companies and subsidiaries of foreign banks.

In addition, Western nations have all kinds of regulations and laws restricting your freedom as an entrepreneur, and are often forcing you to comply with a plethora of stupid quota.

And of course, having your businesses located in a nation that will eventually collapse within your lifetime is a bad idea, for obvious reasons.

Countries such as Ireland or Gibraltar do offer <15% corporate taxes, but as they are located in the West, they do not seem like a valid option.

Fortunately, there are a number of decent countries around the world where you can base your businesses.

In fact, there are some absolutely splendid choices.

There are around 10 countries across the world which charge 0% corporate taxes, but I would not recommend all of them.

In my opinion, if you are considering where to set up a business, you have these options, in no particular order:

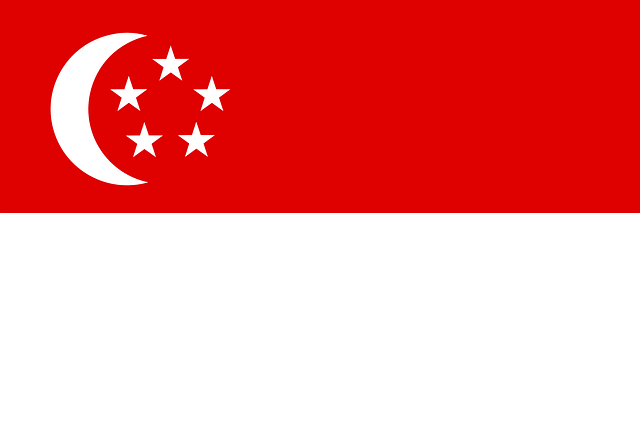

Singapore

The corporate tax rate is 17%. Pretty easy and fast to set up a business, and it doesn't cost a lot. Even though there is a pretty high corporate tax, I still include Singapore because it's one of the very few good options in Asia.

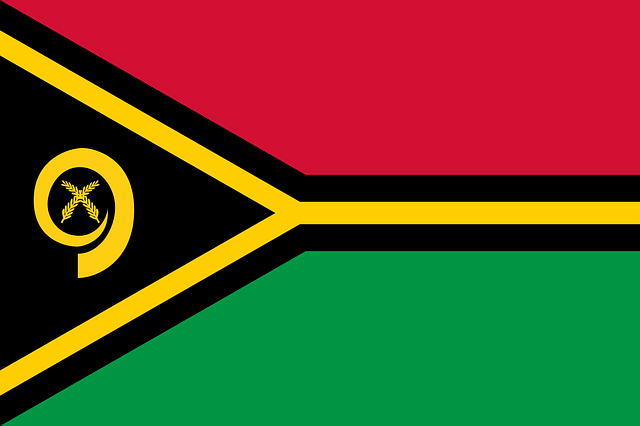

Vanuatu

The corporate tax rate is 0%. A great option, but setting up a business here is more complicated than the other countries in this list. You have to register for all sorts of things and go through quite a bit of paperwork.

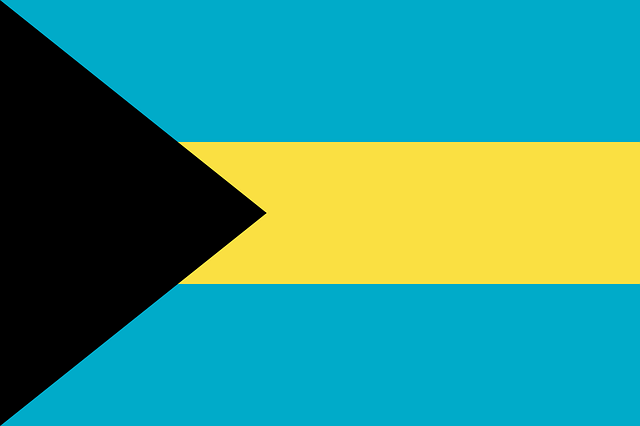

The Bahamas

The corporate tax rate is 0%. They also do not tax profits, personal income, dividends, capital gains, inheritance, gift and unemployment taxes. In the Bahamas you have an additional layer of privacy, and many incentives for international investors. All in all, a great option.

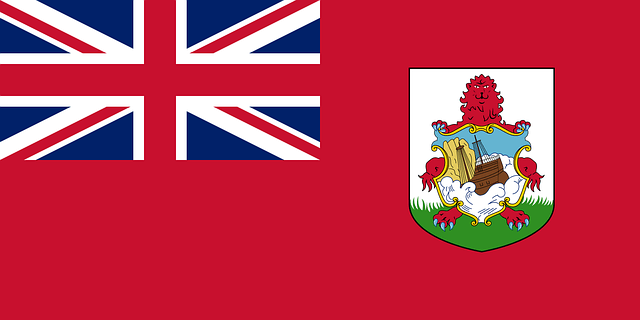

Bermuda

The corporate tax rate is 0%. There are no income or capital gains taxes on corporate entities in Bermuda, nor any withholding, inheritance or capital transfer taxes. This is a major international business center. Setting up a company is pretty easy and fast, but it will cost some money, around $18,000.

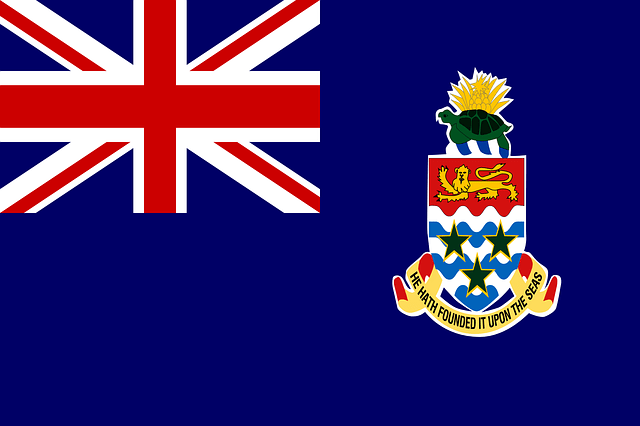

Cayman Islands

The corporate tax rate is 0%. These islands are considered a tax haven. If you want to open a business which operates inside the islands, you must first get permission to open a business, and 60% of your company must be of Cayman ownership OR provide goods/services that are deemed essential to the country. If your business will be conducted outside of the country, the requirements are much, much laxer, with low fees.

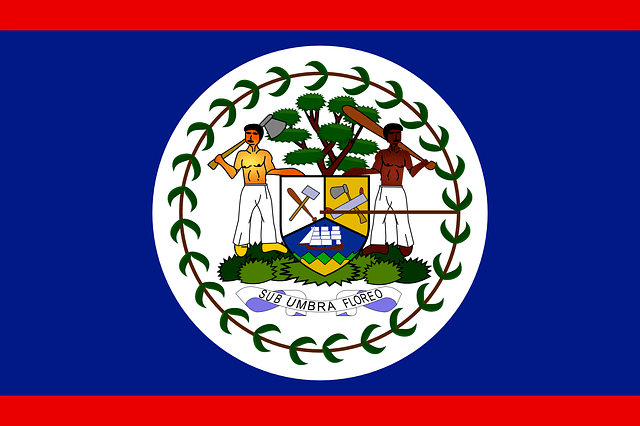

Belize

The corporate tax rate used to be 0%, now it lies between 1.75% and 3%. It is still considered a tax haven because it's easy to set up a(n offshore) business. Belize does not share information with international taxing authorities, which means you have complete privacy. Do keep in mind that the Belizean dollar is tied to USD, which is a really, really bad situation.

Important criteria to keep in mind for your Business Flag are:

- a low corporate tax

- a decent economy (this shouldn’t matter too much, provided you have your Income Flag in other places, but still)

- a politically stable country

- it should be relatively easy to set up a business there, with minimal paper work and bureaucratic hassle

This does not leave many great options, and even though there are plenty of mediocre countries where to set up a business, I would strongly advise you to be very, very picky.

In addition, if you plant your Business Flag in the same nation where you have your Residence and/or Citizenship Flag, you are very vulnerable to any problems that might occur in that nation.

If you run into any sort of trouble legally or otherwise, the government can seize your businesses and its assets.

The same goes for a scenario in which they randomly change their tax laws.

Stay safe and get a Business Flag in another country than where you reside or are a citizen.

Keep your private and business life far apart.

Check out my new book, available on Amazon!

Get the book

Where there is a will, there is a way.