The impact of inflation

The Western world is collapsing – I’ve shown why this is happening, and how this collapse could play out.

One of the options is hyper-inflation.

In addition, even if the West limps on into the future, you’d still have to deal with things like:

- An untenable economic welfare system based on debt

- Political polarization and civil unrest

- Mass immigration of barbarism

- The death of civil liberties

- Increased surveillance

- Warmongering

- A dysfunctional prison system

- A misanthropic legal system

- Impending theocracies

- Heavy taxes

- Increasing cost of living

Today I’ll talk about inflation, a horrible yet unavoidable effect of the current economic system – and one that’s become very pronounced in the last year.

I’ll use euros in this article because inflation seems to be running rampant in Europe currently, and it amuses me.

Check out my new book, available on Amazon!

Get the bookWhat is inflation?

Inflation is a rise in the general level of prices in a particular economy.

Another term is currency depreciation.

In other words, your money will be worth less tomorrow than it is today.

For example:

- This year, a certain product might cost 5 euros, and you have a total capital of 100 euros. Thus, you can currently buy that product 20 times

- The following year, the price of that product rises to 6 euros. With your 100 euros you can now only buy 16 of those

- Numerically you might still have the same amount of money in your possession, but realistically you have lost 20% of value

Inflation is calculated by taking a number of commonly used consumer items (the CPI) and seeing how much they have increased in price compared to the previous year.

The whole concept of inflation is much more complicated than how I’ve described it here, but unless you’re an economist, all you need to know is what I’ve just described, basically.

Inflation usually occurs because more money is put into circulation.

A larger pool of money means that you can buy less with the same amount of money.

Another possible reason is a war (such as the one in Ukraine) which makes certain products suddenly become scarce.

Inflation is a hidden tax, because purchasing power is stolen from the population.

The IMF, the World Bank and the Federal Reserve in America are major causes of inflation in Western countries.

- When large banks lend money to third world countries or companies, it is in many cases secured by the above-mentioned agencies

- If those countries or companies can’t pay off their loans, the banks simply ask for support from governments

- They print some money (billions upon billions), give it to those countries or companies to help pay off the loan

Who ultimately bears the brunt of such malpractice?

You and I, the taxpayers, because when there is more money in circulation, our euros and dollars are worth less and we can buy less food with them.

Anyway, this is a huge topic that whole books could be written about (and have been, check out The Creature of Jekyll Island), so I’ll leave it for now.

Just remember that inflation is the fault of big banks, corrupt governments, other factors such as wars and a financially illiterate population.

What is inflation adjustment?

In order to limit the impact of inflation on consumers in times of crisis, the government sometimes adjusts taxes and other levies so that the price of a particular product remains realistically the same, in terms of purchasing power percentage.

For example, if you see a 2% price increase on a certain product due to inflation, but you get a, say, 10% reduction in taxes on it, the price you have to pay as a consumer remains more or less the same.

How high is inflation?

Inflation in a healthy economy is usually not very high, just a few percentage points.

This is to be expected, and shows that the economy is growing and a decent pace.

But small percentages can make a huge difference over a long period of time.

And what if inflation gets higher?

Then the purchasing power of the population falls much faster than the economy rises, a very dangerous situation, one the West is currently in.

Currently, the official inflation in the US is above 8%, 7% in Canada, and in many European countries over 10%.

Keep in mind this is the official number, which means the actual impact you as an individual are feeling in your wallet is much higher – for example look at the gas and electricity prices.

The impact of inflation

Inflation hits everyone who partakes in the economy, and it has a major impact on people who save money.

If you have a certain amount of money saved up, it will have much less purchasing power within ten years.

Saving money in a bank account is a very bad idea, because the interest you get on such an account is currently lower than the inflation number.

Your money therefore does not yield enough to not lose purchasing power.

If you want to keep the same amount of “real” money, you need to invest it and get a return that AT LEAST matches the inflation rate.

For example

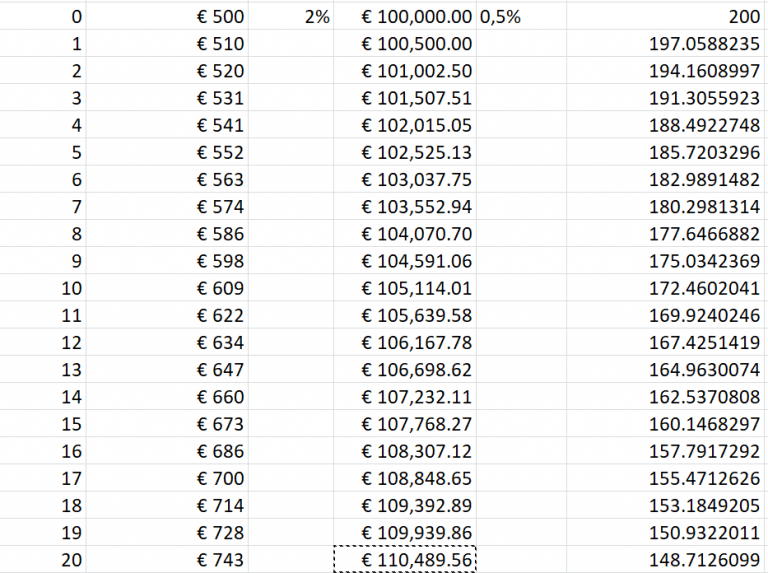

Let’s take a look at how someone would fare with a €100,000 piggy bank, with a 0.5% return on their savings account.

Inflation is on average 2% and we assume a product of €500.

So in the beginning, this person can buy 200 of those (100,000/500).

After ten years, your savings account has grown to € 105,114.

A very poor yield, even with compound interest, but better than nothing.

The price of the product has risen to €609, which means that you can only buy 172 of them, even with your increased money.

Another ten years later you have €110,489 in your account, but the product costs €743, and you can only buy 148 of it.

So in ten years your money will decrease in purchasing power by 14%, and in twenty years even by 26%.

That is the impact of inflation.

That’s why it’s so important to invest your money and not just save it.

How to avoid inflation

If you can achieve a return of 2% on your money, then you remain more or less on par with an inflation rate of 2%.

After all, at the end of the twenty years your money will have increased to € 148,594, with which you can buy exactly 200 times the item with the increased value of € 743.

Now suppose you invest your money in an index fund ETF with a return of 5%.

In 2020-2021 I made more than 35% profit with those, and historically the broad funds get 8%+, so 5% is definitely possible.

After 20 years, your money will rise to € 265,329, thanks to compound interest.

This allows you to buy the €743 item 357 times.

By investing smartly and receiving a modest return, you have not only avoided inflation, you have increased the purchasing power of your money by 178%.

The impact of inflation is not to be underestimated, but if you invest smartly you shouldn’t worry about this… unless society starts to collapse faster and faster and inflation goes above 10%, of course – as it already is in many countries.

You can in principle avoid inflation by investing in real estate as well as investing in shares/funds that pay out dividends, but you have to start as soon as possible.

Cryptocurrency and gold are also excellent ways to avoid inflation, because these markets are not tied to the stock exchanges or a single economy.

Check out my new book, available on Amazon!

Get the book