Assets Abroad: Gold

What is investing in gold?

Investing in gold simply comes down to allocating (part of) your funds to the gold sector.

Gold is an integral part of many investment portfolios for several reasons, which we’ll get to in this article.

You can apply the same principles and the pros and cons that I am going to discuss to the other two popular precious metals silver and platinum.

There are a number of ways you can invest money in gold. The most important are:

Purchase physical gold

Buying physical gold is the most popular and well-known method of investing in it.

You buy physical gold, such as gold bullion, often literally get your hands on it and can/should keep somewhere.

You are also the legal owner.

I can understand the appeal of this, as you are buying something that is valuable and that you can see and actually touch.

Unlike the more abstract forms of investing such as stocks and ETFs, investing in physical gold is something that most people understand and trust, as it has been going on for thousands of years, and has been a staple for the same amount of time.

This is the most simple form of investing in gold, no third party such as a broker or a bank is involved, just you and a seller (or buyer) of gold.

It is quite cheap to store your gold: you can rent a safe somewhere, or just keep it at home in a safe or in a hole in the garden.

I’d strongly advise you against putting your gold in a bank, because banks aren’t loyal to you.

If a government of debt collector comes knocking, they’ll more than likely give up your gold willingly.

The fact that you know exactly how much your investment is worth at any given time is also very reassuring.

If you have, for example, 1 kilo of physical gold, you can simply check online how much it is currently worth and you know exactly how much money you have in your hands.

Check out my new book, available on Amazon!

Get the bookGold ETFs

An ETF is an Exchange-Traded Fund, an investment vehicle that attempts to match the performance of a particular index (kind of like an index fund, but one that you can trade).

In other words: you invest through the stock market in a fund that invests in gold.

As the price of gold rises, so does the value of the ETF.

This is a pretty simple form of investing in gold, you can do this via your computer or smartphone, anywhere in the world.

An advantage (and disadvantage) of this is that you do not have physical gold in your hands.

You don’t have to take care of it or pay to keep it somewhere, but … well, it’s also much more ephemeral.

You do have to pay certain fund costs, both when purchasing/selling and annually for management.

Usually that’s a negligible number, but it’s definitely a factor.

Speculation

You can also speculate on the gold price through brokers like eToro.

This is the same principle as cryptocurrency copy trading, which means you can follow a copy trader who invests in gold.

This is a great option and sometimes even better than investing in an ETF, because it costs little to nothing.

It’s also very simple to do, you don’t have to research what the best gold ETF is, and you can very easily track the status of your investment.

Gold Mines

A fairly risky form of investment, but one that can potentially give you a lot of profit: you can invest in companies that either operate a gold mine or are looking for gold mines.

Of course you understand that in the latter case you run a lot of risk of losing your money, if that company does not discover anything.

But if they do discover a literal gold mine, you also share in the generous profit.

Unlike the options above, I have no experience with this, so I can’t give you any recommendations.

If you are interested in this, I can recommend that you first do a very thorough research into the various options.

Advantages of investing in gold

- You make your portfolio more diverse: investing only in stock ETFs, real estate or bonds can be a good idea … until those markets fail. Investing part of your portfolio in gold ensures that you are more diverse

- Gold covers the risk of financial markets: stocks and ETFs are moderately risky. The returns are also decent, and you can earn passive income with it, but if the market is bad, you’ll be glad you put some of your money into safe, reliable, and stable gold. After all, it isn’t linked to the stock market. If we take a quick look at Ray Dalio‘s portfolio breakdown, we see that he recommends spending 7.5% of your portfolio on gold in order to spread your risk as much as possible

- Investing money in gold offsets inflation: inflation is a huge long-term problem, and I think the primary reason why it’s madness to 1) have a job with a steady income, 2) save more money than needed for your emergency fund, and 3) rely on a pension. Gold increases in value over the years and ensures that you can stay ahead of inflation. Your savings will have much less purchasing power in X number of years than it has now. If you had invested your savings entirely in gold, that gold would be worth more within X number of years, so you have not lost purchasing power

- Gold is a very easily convertible / liquid investment: physical gold is an investment that you can convert into fiat money overnight. If you suddenly need money but all your money is in bonds or real estate, it will take a while before you can convert it into cash. Investments in gold, on the other hand, in the case of physical gold, can be brought to a buyer and sold immediately

- There is a strong and global demand for gold: gold is a globally sought-after commodity. Whether you live in the US, Europe, Turkmenistan or Japan, people everywhere are interested in gold

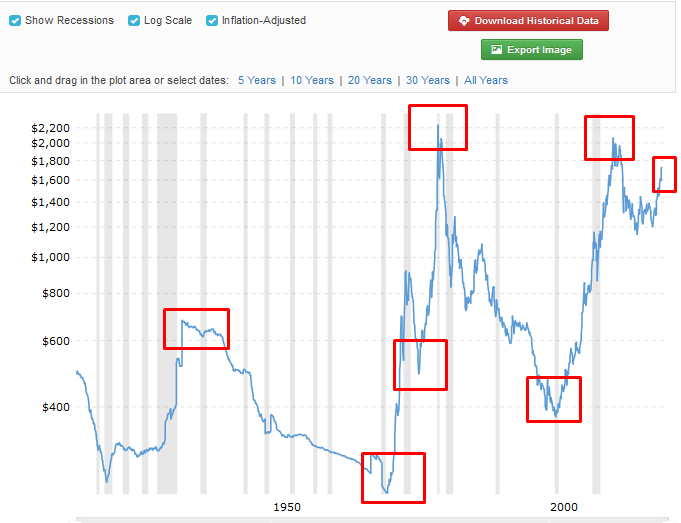

- The gold price always rises in the long run: in the long run gold rises in value by an average of 9% each year. That is slightly less than the stock market, but certainly not a bad yield

- When society collapses, you can use your gold to buy food. Sounds a bit ridiculous, but what if the economy actually collapses? The whole fiat money system is based on debt, there is no intrinsic value behind it. I don’t think that’s tenable, and if we look at the past, situations with central banks that can print almost unlimited money have always derailed (you can look it up if you don’t believe me). The only fixed value since the dawn of humanity (more or less) are intrinsically valuable and rare metals and stones, which are globally recognized as means of payment

Disadvantages of investing in gold

- Gold yields nothing, there is no flow of income. Yes, it increases in value every year, just like real estate and stocks, but unlike those assets, gold does not bring in a flow of income. That isn’t a massive disadvantage because gold has other advantages, but if you are investing your money with the hopes of earning passive income, you should definitely take this into account

- The gold price can be quite volatile in the short term, just like cryptocurrency and stocks. Not really a hugely important factor in my opinion, because short-term investing is not a good idea for most people

- If you have physical gold, you have to keep it somewhere. If that is at the bank or elsewhere in a safe, you may have to pay for it. If you do that at your home, it could be stolen. If you keep it at a bank, the government of other entities can “legally” take it. This also raises a problem for digital nomads, or just financially independent people who move to a different location every few years. Carrying around a few pounds of gold isn’t always a good idea. Of course you could just invest in a gold ETF or speculate on the market

Is investing in gold a good idea?

Investing in gold is generally wise, due to the following factors:

- It contributes to more portfolio diversification. It is a safe investment to counter inflation and the riskier aspects of your portfolio

- You can make an average profit of 9% per year in a reliable, simple and liquid way

- There are four methods of investing in gold, depending on your situation, preferences and risk tolerance

That being said, you should of course keep in mind that there are also drawbacks, mainly that physical gold can be a problem if you travel a lot, and that gold is not a source of passive income.

In general, investing in gold is wise and spending part of your portfolio on gold is a good idea. How you do that and to what extent, is something you’ll have to decide for yourself and include in your investment plan.

Check out my new book, available on Amazon!

Get the book